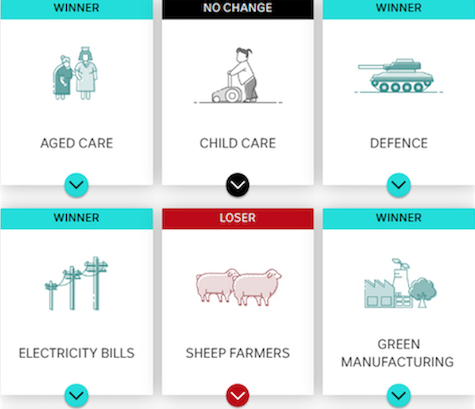

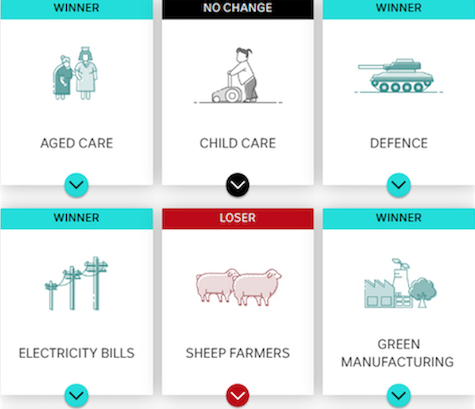

Winners & Losers

Jim Chalmers has handed down the government's third budget, with a $300 power bill boon for every Australian household, but the purse strings kept tight on other measures.

Jim Chalmers has handed down the government's third budget, with a $300 power bill boon for every Australian household, but the purse strings kept tight on other measures.

In May and June, we will add two articles to our website that help you plan and take action before the end of the 2023-24 financial year. Both Part 1 and 2 will cover the following, though Part I focuses on key strategies to manage your tax bill. All are worth dedicating time to review and think about how your business can organize your affairs in these ways.

Consumers remain deeply pessimistic about the near-term outlook for the economy despite signs of improvement last month, says the major bank.

The following is a list the ATO has compiled that is tailored to occupations and industries.

The new financial year is fast approaching and so are a number of changes to superannuation contribution amounts and the individual tax rates. These changes are outlined below, as is some information on how you may be able to work with these changes when managing your tax affairs during 2024-25.

The ATO has developed quite a number of benchmarks to help small businesses develop an idea of their performance compared to similar businesses in the same industry.

New guidance has been released on best practice principles for debt notifications in response to the re-activation of old debts by the ATO.

Select your desired option below to share a direct link to this page