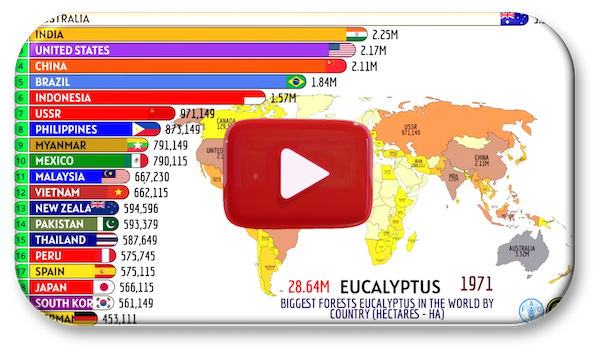

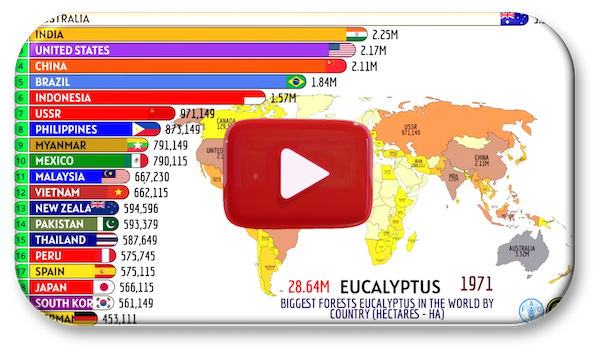

Countries with the largest collection or eucalyptus trees

Check out the countries that have started to grow their eucalyptus tree stocks

Check out the countries that have started to grow their eucalyptus tree stocks

The latest Financy Women’s Index (FWX) for the September quarter has shown the superannuation gender gap is closing, with true parity between men and women now predicted to be achieved in a more rapid timeframe.

The Australian Taxation Office (ATO) has observed websites attempting to harvest personal information such as Tax File Numbers, identity details and myGov login credentials under the guise of providing “super advice”.

The Medicare levy’s a compulsory charge of 2% on taxable income, which helps fund Australia’s public healthcare system.

Passage of the Payday Super reforms by parliament this week has cleared the way for employee superannuation to be paid by employers more frequently. In the first of a two-part series, this article explains the myriad elements of the new law.

Following on from the Tax Office’s move to refresh its approach to rental property tax deductions, tax advisers are warning holiday home owners to be wary of the coming changes.

Take out the guesswork out of choosing the right structure for your business

Family businesses form the backbone of the Australian economy, with many starting as simple partnerships before evolving into more complex structures

As differing opinions circulate at the top end of town about the potential impacts of a net cash flow tax, its effect on SMEs could add to their daily struggle in the current regulatory environment.

Check out the countries that have been born from some of the largest empires in history.

Select your desired option below to share a direct link to this page