ATO figures reveal final 2022 DPN tally

After a slow start in May, figures show how the office went up through the gears with director penalty notices.

After a slow start in May, figures show how the office went up through the gears with director penalty notices.

With illegal early access schemes on the rise, the Tax Office has issued a fact sheet warning super members about the promoters of these schemes.

The ATO fails to resolve the key question of what constitutes “ordinary family and commercial dealing”, tax professionals say.

Charges are pending following an operation with the Australian Federal Police (AFP) that uncovered 70 sales systems using suppression technology.

With the eligibility age for downsizer contributions now age 55, the SMSF Association has highlighted some important considerations for younger clients looking to use the measure.

More demanding record-keeping requirements in the November draft have been in place since 1 January.

Loans to members and financial assistance continues to be the most commonly reported type of contravention based on ATO statistics.

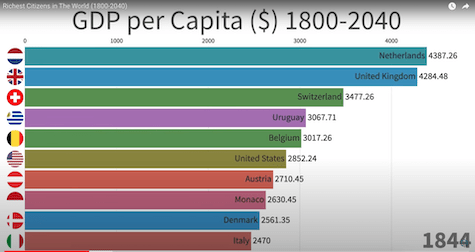

Check out 240 years of countries with the highest GDPs per capita

You and your business can still be held responsible for injuries that happen in the home while carrying out work-related duties.

We see common behaviours among small businesses that get their tax right. These tips will help you to pay the right tax.

Select your desired option below to share a direct link to this page