What is Single Touch Payroll Phase 2?

In the 2019–20 Budget, the government announced that Single Touch Payroll (STP) would be expanded to include additional information.

In the 2019–20 Budget, the government announced that Single Touch Payroll (STP) would be expanded to include additional information.

Six biggest bull markets in US stocks/shares since 1962 and their subsequent bear markets.

If you operate some or all of your business from your home, you may be able to claim tax deductions.

To avoid additional costs (including the superannuation guarantee charge (SGC)), you must pay the right amount of super for all your eligible employees by the quarterly due date.

The government has revived two initiatives that give small businesses 120 per cent tax deductions for spending on training and digital uptake which were first announced in the March budget.

In light of the recent Optus data breach, we thought it timely to provide a list of things you should consider to help protect your identity

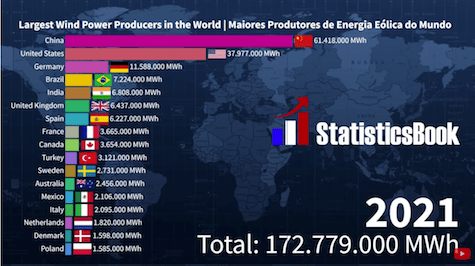

Check out the worlds largest wind power producers from 1990 to 2021

Cyber crime and data breaches are rated higher as threats by executives in the Asia Pacific than by their global counterparts, with more than half saying security risks had risen over the past 12 months.

A reminder regarding rules for allowing eligible people to claim tax deductions for the unused portion of their super concessional contributions caps from prior years.

Many small businesses employ workers on a verbal agreement. But what happens if a dispute arises over the terms and conditions of someone’s employment – and there is nothing in writing?

Select your desired option below to share a direct link to this page