Federal Budget 2022 – Overview

The following is a breakdown of the major parts of the Federal Budget delivered last night by the Treasurer, Josh Frydenberg.

The following is a breakdown of the major parts of the Federal Budget delivered last night by the Treasurer, Josh Frydenberg.

Between the 1st of July 2022 to the 1st of July 2026 there will be five SG increases.

The Federal Court are satisfied with asset betterment principles – a controversial approach the Australian Taxation Office (ATO) takes to determine undisclosed income.

It’s helpful to keep the distinction between burnout and stress clear so as not to burden individuals with responsibility for fixing workplace issues that require management attention, writes Dr Karen Morley.

The accounting profession is being encouraged to aid small businesses through their digital transformation journey, with the Morrison government making a $2.8 million commitment to streamline electronic transactions.

ATO has embarked on a new campaign to target private wealth groups withholding tax on overseas royalties.

The ATO has released a suite of new guidance products that is set to have a major change on family trust distributions and tax arrangements.

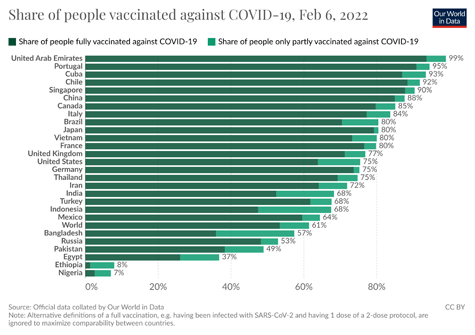

61.4% of the world population has received at least one dose of a COVID-19 vaccine. 10.2 billion doses have been administered globally, and 18.22 million are now administered each day. Only 10% of people in low-income countries have received at least one dose.

Given the enormity of Russia's decision to invade Ukraine, this note provides a short update on the potential market implications.

CPA Australia says the legislative reforms under the Better Advice Bill do not meet the intent of Recommendation 7.1 of the Tax Practitioners Board Review and should be included in the Quality of Advice Review.

Select your desired option below to share a direct link to this page