Home Office & end of 2021 tax year

In a Covid-ravaged financial year, small business owners need consider what actions now can benefit in saving income tax. Taxpayers with the best records often have the best deductions.

In a Covid-ravaged financial year, small business owners need consider what actions now can benefit in saving income tax. Taxpayers with the best records often have the best deductions.

Working from home because of COVID-19 means most will have more deductions than in a normal year. These checklists will help your tax agent ensure you don't miss any deductions. Simply print, complete and return.

Whether starting a new business or re-planning an existing one, a business plan is always a good idea. Getting professional help drafting you plan is

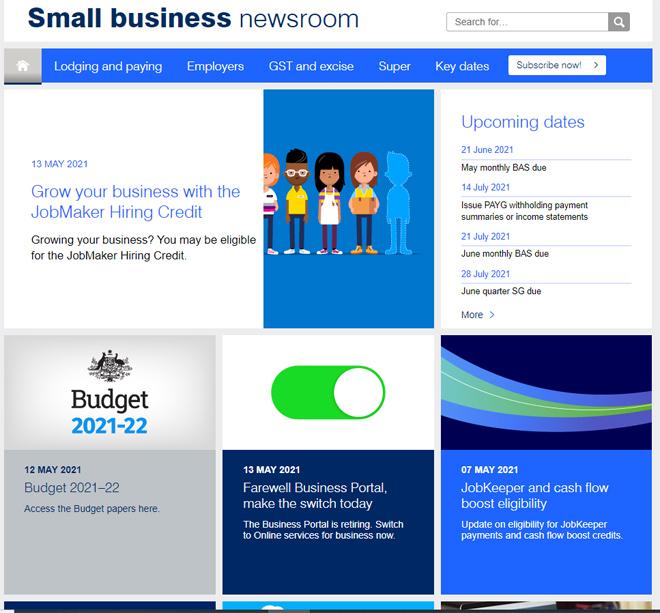

The federal budget 2021–22 was handed down by the Treasurer, the Hon Josh Frydenberg MP, on 11 May 2021. This article considers the key issues as we wait for the legislative amendments to give effect to the budget measures.

The Tax Office has urged advisers and taxpayers alike to heed its guidance on accounting for cryptocurrency come tax time, when it will be looking to ensure that all capital gains events are accurately reported — not just gains.

How countries have evolved during this 65 year period is fascinating stuff to watch. This chart is based on IMF Reports. Click on the following image

The ATO provides information on a large number of business related topics, issues, rules and regulations. We hope this article will help quickly you keep up to date.

Often watching a short video is a quicker way to understand what can otherwise be quite confusing. The following titles have just been added to our website and can be accessed at any time and by anyone.

Small employers with closely held payees have been exempt from reporting through single touch payroll (STP).

Select your desired option below to share a direct link to this page