What’s Happening to Small Business Loans in Australia?

Will 2020 Crisis Continue in 2021? 2020 was hard on small businesses worldwide.

Will 2020 Crisis Continue in 2021? 2020 was hard on small businesses worldwide.

Although 2020 saw a temporary lull in the ATO and State Revenue Office’s usual activity level due to the COVID-19 pandemic, 2021 is already set to be as busy as ever when it comes to audits and reviews initiated by government revenue authorities.

The cost of retirement for Australians has gone up, with the increases in health insurance and domestic holiday prices, according to the Association of Superannuation Funds of Australia’s (ASFA) latest figures.

The Tax Office has released long-awaited partnership profit guidelines, three years after it first commenced a review of how professional firms engage in income splitting.

With JobKeeper ending in four weeks, small businesses have been urged to “act early” on exploring their insolvency options before the ATO moves on recouping debts.

Superannuation remains the best available form of an individual retirement savings plan, in spite of continuing government changes.

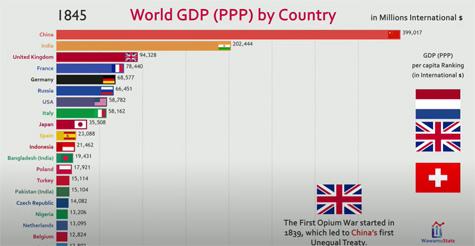

The information in this chart is fascinating from both an historical perspective as well as what it predicts. It also guarantees you'll be the BBQ expert every time.

A HECS-style loan scheme for businesses, currently being considered by the Treasury, would provide a lifeline for many industries recovering from the economic shock of COVID-19, says the small business ombudsman.

The Tax Office has agreed to push back the start date for the second phase of Single Touch Payroll after intense pressure from all corners of the profession.

Select your desired option below to share a direct link to this page